[ad_1]

I used to be poking across the Bogleheads discussion board after I found this thread about an interval fund.

I’ve heard of all types of funds, however that is the primary time I’ve heard about interval funds. Concerning funds, I’m just about an index mutual fund or index exchange-traded fund (ETF). They’re all at Vanguard, although I feel Constancy, Charles Schwab, and all the opposite low-cost suppliers are nice, too.

Interval funds are a totally completely different animal, and, on this case, the unique poster invested in a Variant Different Earnings Fund (NICHX):

Thanks upfront in your time. Two years in the past I used to be coping with some anxiousness in my life. My spouse and I made the choice to enlist an advisor to handle a portion of our holdings. That turned out to not be the precise factor to do and he didn’t serve us effectively. Now we have terminated his contract and now I’m working to reallocate our accounts into extra acceptable funds.

He invested a not-insignificant quantity of funds right into a Variant Different Earnings Fund (NICHX). I assume it’s thought of an “interval fund.” That I can solely exit quarterly. The value-per-share has been flat, nevertheless it pays an honest quarterly dividend that’s routinely reinvested. An preliminary funding of $103k in late 2022 has paid over $15k in dividends over six quarters (545 new shares).

This in fact triggers the very anxiousness I wrestle with. My intention was to get to a 70/30 AA. I assume my choices are:

1) Get out of the fund as quickly as the following quarterly-sell interval opens.

2) Preserve all or some and attribute it both to the fairness aspect or the bond/money aspect of my AA.

3) Preserve all or a few of it, however depart it exterior of my AA (which means faux it’s not there).Your knowledge is welcome.

Desk of Contents

What’s an Interval Fund?

An interval fund is a mutual fund that could be a closed-end fund the place you may solely promote your shares throughout a repurchase interval. This era varies from fund to fund however many are on a quarterly interval and the fund will state what number of of their excellent shares they may repurchase (redeem), normally acknowledged as a share.

If you happen to learn “closed-end fund” after which “redemption intervals” and already knew what a closed-end fund was, this might be complicated. Sometimes, closed-end funds problem shares at an IPO after which by no means purchase them again. The shares can commerce on the open market, however new cash doesn’t return into the fund.

With an interval fund, they’re in between open-end and closed-end funds as a result of they’ll supply new shares however solely redeem them at numerous intervals (quarterly, semi-annually, and so forth.) and just for a set share of belongings.

I wager you may see how issues get tough as a result of this fund is comparatively illiquid. If an interval fund says they’ll repurchase 10% and greater than 10% of the shares need to be repurchased, everybody will get pro-rated down.

This construction advantages the interval fund as a result of quite a lot of redemptions may cause issues for the fund, because it has to give you the cash to offer again to shareholders. With a set cadence for coping with redemptions, the supervisor can plan for them (each in timing and dimension).

The scheduled redemptions permit managers to spend money on extra complicated securities and contracts, which can themselves be extra illiquid.

NICHX: Peek at an Interval Fund

The Bogleheads put up talked about NICHX, so I assumed I’d look nearer at this.

NICHX is fascinating – it invests in unconventional income-generating belongings like litigation finance, royalties, and so forth. It’s a fixed-income fund, so don’t examine it to an S&P 500 index, and it invests in different money circulation belongings that I’ve checked out beforehand.

It’s an interval fund that doesn’t commerce on the open market, so the one solution to promote your shares is thru NICHX. Not like many interval funds, although, there doesn’t seem like a gross sales cost.

You’ll be able to see that NICHX compares itself with many fixed-income belongings, such because the Bloomberg U.S. Combination Bond Index and Bloomberg U.S. Excessive Yield Bond Index, which appears affordable. They beat the fully principal-safe T-bills and examine favorably with high-yield company bonds and the like.

With interval funds, it’s essential to grasp the method and asset lessons that they spend money on, in addition to the charges. These funds do much more than monitoring an index, in order that they usually cost rather more.

For NICHX, we see that they’ve a internet expense ratio of 1.67% (which incorporates the Administration charge of 0.95%). Additionally, NICHX solely permits a quarterly redemption of 5% of the fund’s internet asset worth.

Is that this costly? It appears to be like costly in comparison with an S&P500 Index fund that costs you solely 0.04%, however that’s not a good apples-to-apples comparability as a result of they’re invested in several issues with completely different threat profiles.

It’s important to examine it with one thing that invests in different investments.

Yieldstreet Different Earnings Fund

Yieldstreet affords a Yieldstreet Different Earnings Fund that benchmarks towards the Bloomberg U.S. Combination Bond Index and Bloomberg U.S. Excessive Yield Bond Index. It invests in income-producing different belongings like industrial actual property, plane, authorized finance, provide chain finance, artwork finance, and so forth.

In addition they restrict redemptions to twenty% of shares excellent within the prior calendar yr or not more than 5% in every quarter, on a quarterly foundation—the identical as NICHX.

As for charges? 1.50%. It’s barely cheaper than NICHX however throughout the identical ballpark. (no gross sales load both)

The half that’s barely complicated about this fund is that they listing this as their charges:

If that’s onerous to see:

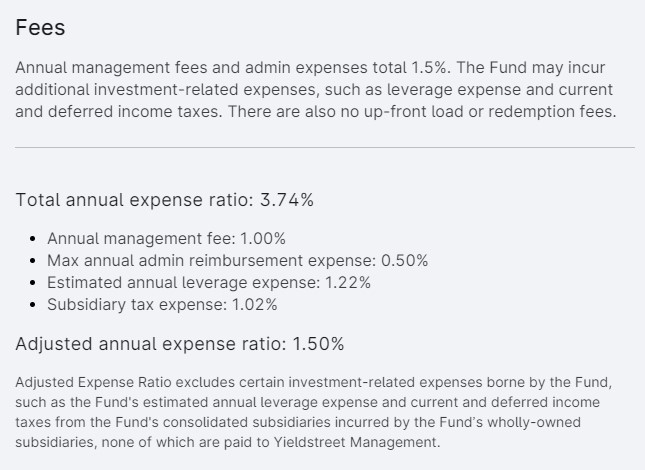

Charges

Annual administration charges and admin bills complete 1.5%. The Fund might incur extra investment-related bills, equivalent to leverage expense and present and deferred revenue taxes. There are additionally no up-front load or redemption charges.

Whole annual expense ratio: 3.74%

- Annual administration charge: 1.00%

- Max annual admin reimbursement expense: 0.50%

- Estimated annual leverage expense: 1.22%

- Subsidiary tax expense: 1.02%

Adjusted annual expense ratio: 1.50%

Adjusted Expense Ratio excludes sure investment-related bills borne by the Fund, such because the Fund’s estimated annual leverage expense and present and deferred revenue taxes from the Fund’s consolidated subsidiaries incurred by the Fund’s wholly-owned subsidiaries, none of that are paid to Yieldstreet Administration.

The three.74% contains “estimated annual lever expense” and “subsidiary tax expense,” that are objects we don’t see in NICHX. I’m unsure why they embody them as they aren’t paid to Yieldstreet. Maybe they’re included within the returns of different funds (different funds may have related bills, although I don’t typically see them itemized like this).

The 1.50% itself, although, is on par with NICHX.

In doing extra analysis on interval funds, you’ll discover that they’ve larger charges, although, so the 1.69% at NICHX and the 1.50% from Yieldstreet are typical. You gained’t see charge buildings like index funds, and that is smart; these funds execute complicated transactions and don’t simply observe an index.

Do You Want Interval Funds?

Right here’s the massive query – do it is advisable spend money on interval funds?

I’d argue most individuals don’t.

If you happen to have a look at the unique poster from Bogleheads, his advisor put at the very least one million bucks (that’s the minimal for NICHX) into this fund, and he wasn’t even certain why. That’s a foul signal. If you happen to don’t perceive, you must preserve asking questions till you do. They be just right for you, and if they’ll’t clarify it, they aren’t ok.

As for interval funds generally, are the returns that a lot better to justify the illiquidity? You’ll be able to solely get 5% out each quarter, so at a minimal, you’re speaking 5 years to exit the holding absolutely… and that’s in the event you don’t get pro-rated.

The 1.50%+ charge also needs to be an enormous concern. The charge could also be justified, nevertheless it doesn’t imply you could purchase the product. With investing, now we have extra management over the fee than the returns, so paying a better charge means our funding has a a lot larger hurdle to beat.

For many, you might be higher off with a easy three-fund portfolio or one thing equally easy. There could also be some instances the place you’d need one (and maybe one which invests in one thing else). However for many, it’s a go. (heck, earlier than you ever get to the upper price, the illiquidity is sufficient to make me balk)

As for this asset class, “different investments” are enjoyable to examine and research, however they’re hardly required in any portfolio. I personal some farmland by means of AcreTrader and artwork through Masterworks, however that’s small quantities for enjoyable relatively than as a result of I feel they’re a crucial a part of my portfolio.

[ad_2]